Bloomberg, Wall Street Journal, and Financial Times have been dead wrong each time they have declared gold to be dead.

Bloomberg Opinion (June 28, 2023) recently published an op-ed headlined “Gold Is No Longer a Good Hedge Against Bad Times”.

Link to Bloomberg article: https://www.bloomberg.com/opinion/articles/2023-06-28/gold-is-no-longer-a-good-hedge-against-bad-times

There’s a problem, though. Crescat’s Tavi Costa was correct to point out that another major media outlet, the Wall St. Journal, had published an eerily similar headline just last year (Sept. 22, 2022) – on its front page – “Gold Loses Status as Haven”.

Wall St. Journal Publishes “Gold Loses Status as Haven”

What’s the problem, you ask, mainstream publications are constantly badmouthing gold, nothing out of the ordinary here? Well, the problem is that the Wall Street Journal’s front page hit piece was published on almost the exact day that gold bottomed, then broke out and marched upwards to $2,000. Essentially, the Wall St. Journal published its anti-gold piece at the precise bottom ($1,657 gold price), subsequent to which its increased in price by 20%.

So they weren’t just wrong, they were 180-degrees wrong, meaning if an investor just did the opposite, they would look prophetic. Costa of Crescat’s prediction is that Bloomberg’s latest anti-gold publication will look just as fallacious, with the benefit of some hindsight.

Interestingly, in 2010, the Financial Times published a piece entitled “Remember 1980: All That Glisters Is Not Gold“, saying that “gold is always speculation”.

The FT author began by saying “I never enjoy writing about gold. It is not that I have anything against the metal; its importance to the financial system is undeniable.”

Nothing wrong, just another anti-gold mainstream media article; except again, this piece was published at $1,327 gold – almost immediately before it shot up to nearly $1,900 for the first time ever.

Ironically, the Financial Times did include the following proviso:

“Perversely, therefore, buying gold now is the optimistic thing to do. To succeed, governments and central banks have to be prepared to overshoot. If they even momentarily cause the kind of inflationary panic that we saw in early 1980, then gold could get back to its peak in real terms. That would mean rising 40 per cent from here to $1,875 – so another true gold bubble is a real possibility. But anyone making this bet needs to remember what happened to gold after 1980.”

Link to Financial Times article: https://www.ft.com/content/2919c20a-de09-11df-88cc-00144feabdc0

Indeed, gold did hit that $1,875 price exactly within the next couple years.

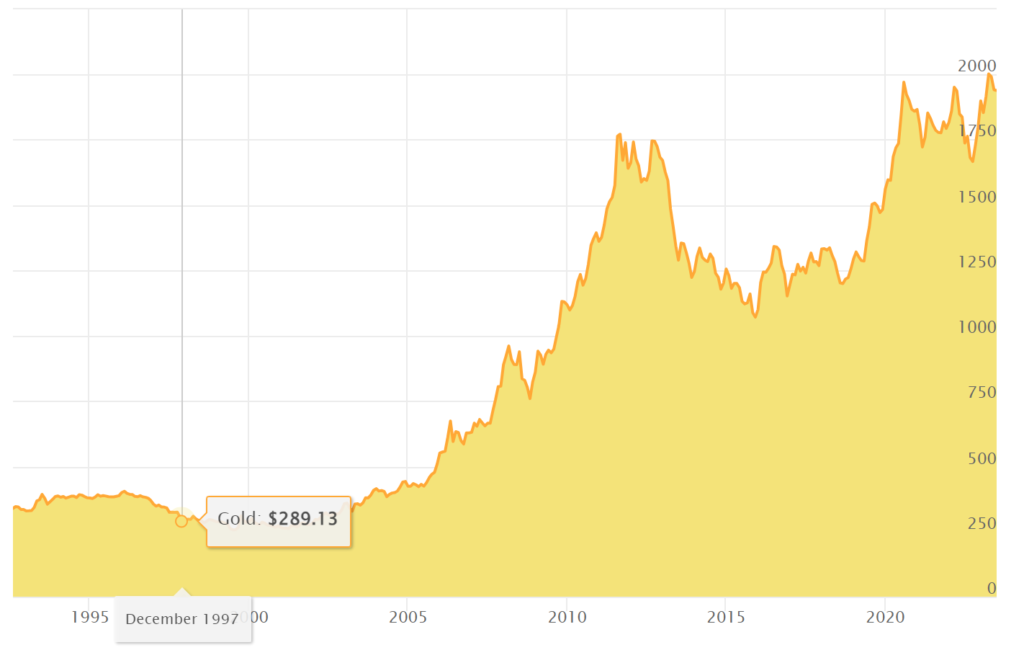

The good folks at Canadian fund manager Ninepoint Partners (formerly known as “Sprott”) went back even further, and dug up a Financial Times cover article from December 14, 1997, headlined “Death of Gold”. They declared that “Gold has fallen from grace and is now a mere metal and a bad investment.”

Pardon, the repetition, but let’s take a look at just how wrong they were:

Financial Times Declares Gold “Dead” & “Bad Investment” (Dec. 1997)

Investors who did just the opposite have seen gold enjoy its 692% increase.

According to Ninepoint, “The turbulence that has wrecked the financial markets through 2022 has impacted various major currencies. The value of the Euro is on par with the US Dollar today. Similarly, the British pound is rapidly approaching parity with the US Dollar. The Yen has lost almost 30% of its value when measured versus the US Dollar. In all the above-mentioned currencies, save for the US Dollar, gold has served as a wonderful haven. The appeal of gold has not been lost to the Central Banks around the world. During the second quarter of 2022, global central banks added nearly 180 tonnes of gold to their coffers on a net basis. We also saw exceptional demand for gold from China and India, two of the world’s largest gold consumers. In China, demand for physical gold was so strong that people have been paying premiums approaching $50/oz for the metal, a sharp departure from 2020 when demand had dried up as a result of COVID. We are seeing a similar story play out in India, the largest importer of gold in the world. Robust demand has led to large premiums being paid for bullion – approaching nearly $70/oz in some instances.”

Link to article: https://www.ninepoint.com/commentary/commentaries/2022/092022/gold-precious-minerals-fund-q3-2022/

The Financial Times piece from 2010 they concluded their article by warning against purchasing gold, saying “Gold could indeed be insurance against runaway inflation, but even its truest believers should also guard against the risk of deflation.” Hopefully, smart investors did the opposite, and bought some gold.