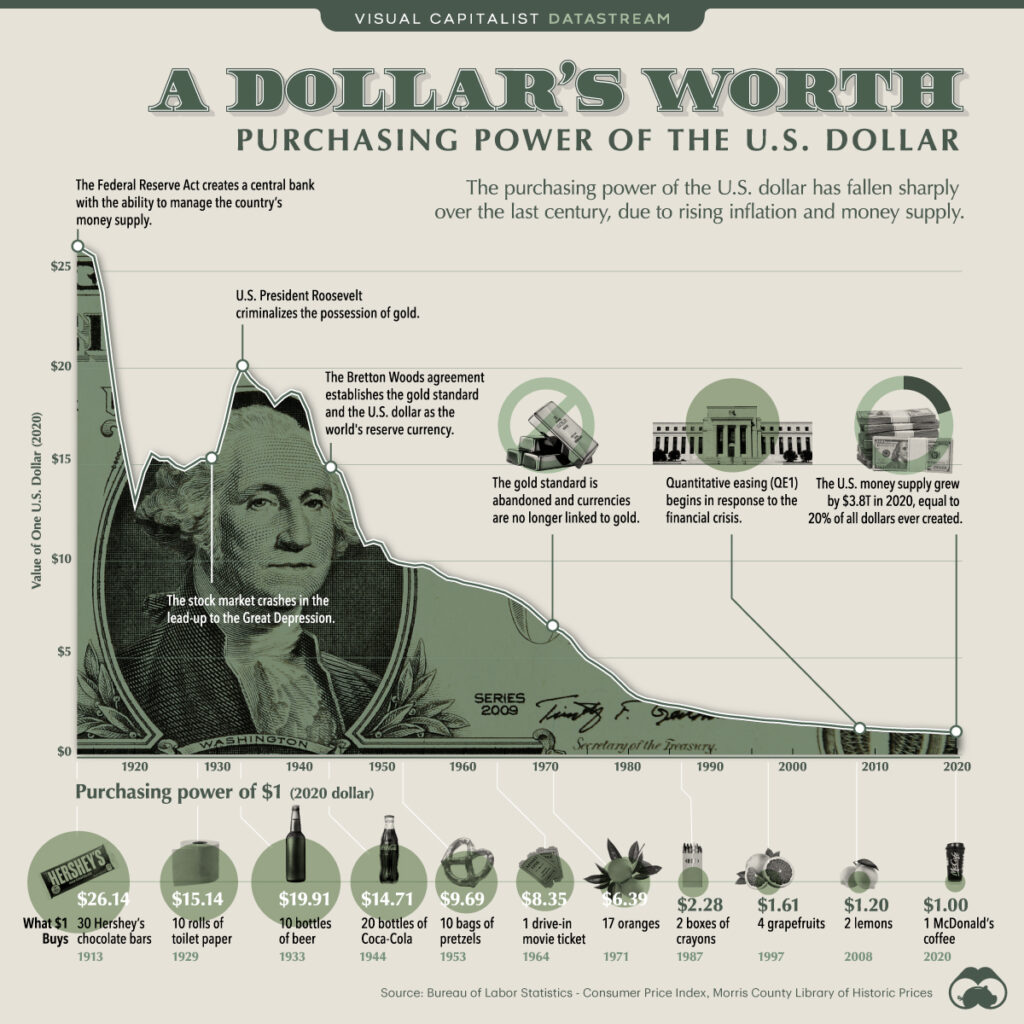

The value of $1 has eroded by 95-97% since the Federal Reserve was established.

Contrast that with gold, which has maintained its purchasing power.

In % terms, this chart shows a 96% value erosion over the past 100 years. In essence, if you held onto a $1 bill for a century, you would have 3.8c of value.

The following was produced by the Visual Capitalist (https://www.visualcapitalist.com/purchasing-power-of-the-u-s-dollar-over-time/).

According to one source “The gold-to-decent-suit ratio is an old rule of thumb that some investors use to demonstrate the stability of gold’s purchasing power. In Ancient Rome, an ounce of gold could buy a toga for a senator. In 1960, Don Draper could buy a Brooks Brothers suit for $USD 35 — the cost of an oz of gold. Currently, the price of an ounce of gold sits at ~$USD 1900, the cost of a Canali suit (fitted, of course). Using the gold-to-decent-suit ratio in today’s economy suggests that the buying power of gold has actually grown (and so has our style sense, apparently).”