Crypto fund manager and early crypto advocate Marcus Abramovitch publicly predicted the FTX crash. He also believes there should be more crossover; crypto investors ought to consider adding some exposure to gold and vice versa:

“Anyone who understands the reasons to have a crypto allocation in their portfolios should consider thinking about gold as well. Similarly, precious metals investors would benefit from considering diversification into cryptocurrencies such as bitcoin. We have a lot in common after all. It’s my feeling that the majority of especially young crypto investors would benefit from more diversification than they currently practice.”

Marcus Abramovitch, Crypto Investor

History of FTX

According to Bloomberg (July 19, 2022), “Sam Bankman-Fried, wunderkind quant-turned-cryptocurrency billionaire, carried out a dealmaking spree unlike any other in the brief history of the industry… To his legions of hardcore fans, this is further proof that SBF, as they all call him, is the patron of crypto, a benevolent, deep-pocketed investor and philanthropist who’s defending the industry in its time of greatest need. Perhaps. An alternative interpretation is that Bankman-Fried’s wheeling and dealing have revealed the full scope of his plans to dominate the crypto industry.” Link to article.

On September 27, 2022, Forbes ran a headline “Sam Bankman-Fried Keeps Bailing Out The Crypto Industry” and gushed over SBF who they said “has again proved himself to be the savior of the crypto world this week as he won the auction for embattled brokerage Voyager Digital’s assets. The second-youngest billionaire (after his FTX cofounder Gary Wang) is no stranger to swooping in with credit lines and bailouts to ease the woes of some of this year’s most troubled companies. It’s not surprising, then, that the 30-year-old has been compared to J.P. Morgan during the crisis of 1907.” Link to article.

Keep in mind that in January of that same year, FTX raised $400-Million at a $32-Billion valuation. That’s the same valuation of Newmont (which includes GoldCorp which it acquired for $10-Billion in 2019), the largest gold miner in the world, producing 6,000,000 ounces of gold per year, resulting in $12-Billion in annual revenue with 2022 EBITDA at $4.5-Billion.

So, FTX was the recipient of huge amounts of fawning media and hundreds of millions of venture capital and valuations exceeding the most established mining companies in the world. But wait, there’s more. FTX also received huge endorsements and promotion from celebrities. Contrast this with gold & silver, the oldest asset class on the planet – which has withstood the test of time – and which still receives little attention whatsoever. (In fact, that’s one of the reasons we started the Gold & Silver Index and GoldBug/GoldSilverBugs channels. We believe gold & silver are hugely underappreciated despite their impeccable track record of storing value.)

Footballer Tom Brady and ex-wife model Giselle Bundchen famously promoted FTX, seemingly everywhere. Media reports insinuated that the couple had “invested” up to $80-Million in FTX, although it’s unclear whether they actually invested any cash out-of-pocket, or rather were given shares for their promotional services (like Kevin O’Leary admitted was his case). As an aside, the New York Post and Gawker reported that Brady has actually deleted his tweets related to FTX.

Nonetheless, thanks to internet archivers, you can still see all the times Brady pumped FTX:

Summary

To summarize, in January of 2022, FTX raised capital at a $32-Billion valuation. In February, FTX spent $37-Million on Superbowl commercials. In June, the Miami Heat arena (formerly the American Airlines Arena) is renamed to “FTX Arena” in exchange for $135-Million. From July – September, both FTX and Sam Bankman-Fried received fawning media attention from mainstream outlets like Bloomberg and Forbes.

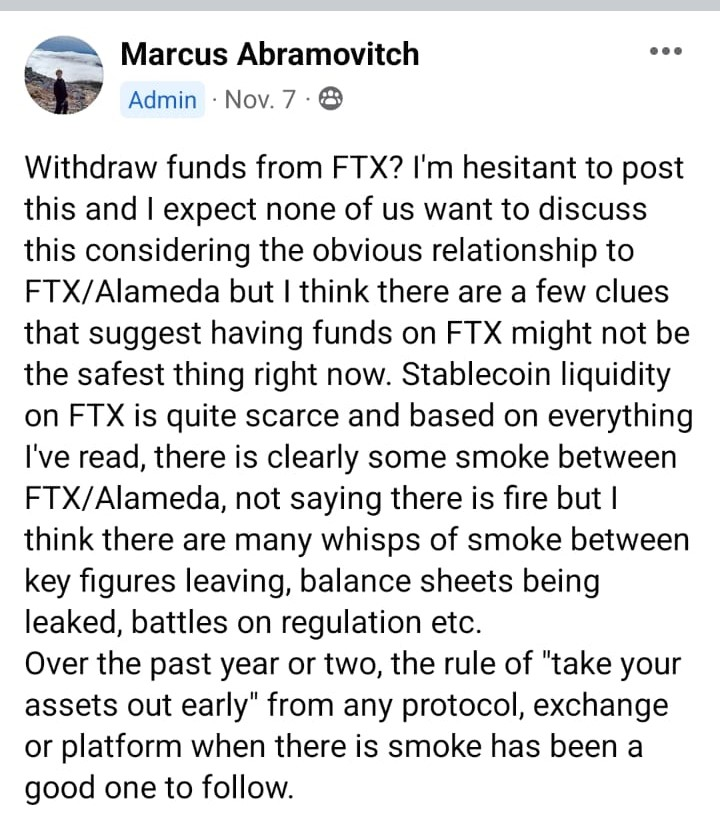

Then, on November 2, 2022, crypto news site Coindesk leaked a copy of FTX’s balance sheet, which showed how reliant the firm was on its own “FTT” token. On Nov. 7, SBF said that “FTX is fine. Assets are fine.” On that same day, crypto investor Marcus Abramovitch withdrew his funds from FTX. The next day, Nov. 8, Binance announced that it had signed a Letter of Intent to acquire FTX due to its “liquidity crunch”. On Nov. 9, Binance withdrew from the deal, and on Nov. 11, FTX filed for bankruptcy.

Crypto Fund Manager Raises Red Flag

Not only did Mr. Abramovitch withdraw funds from FTX on Nov. 7, 2022, but he also cautioned others to consider following suit. His pubcliy published post argued that it was safer to cash out given that when there is smoke there is often fire. He said, “the rule of take your assets out early from any protocol, exchange, or platform when there is smoke, has been a good one to follow.” Here is a snapshot of his post:

Interestingly, Mr. Abramovitch believes that cryptocurrency investors have a lot in common with gold investors. Both crypto and gold investors are seeking a store of value immune against inflation. Both are weary of governments ability to regulate currencies. Both desire a better alternative to fiat paper money.

Mr. Abramovitch told us: Anyone who understands the reasons to have a crypto allocation in their portfolios should consider thinking about gold as well. Similarly, precious metals investors would benefit from considering diversification into cryptocurrencies such as bitcoin. We have a lot in common after all. It’s my feeling that the majority of especially young crypto investors would benefit from more diversification than they currently practice.”

We believe that gold should not be pitted against crypto, when in reality gold and crypto investors are seeking the same thing, security; hopefully with potential for appreciation rather than erosion.