Eric Sprott recently spoke about the recent decade when the market at large, crashed, while gold

See video “Market Crashes 77% and Gold Rockets 525%? It already happened according to billionaire Eric Sprott” https://www.youtube.com/shorts/PNxIMnxrHms

In his presentation, Sprott first discussed the Nasdaq decreasing 77.4%

Chart of Nasdaq 1999 – 2011

He contrasted that dive with the price of gold in the same period, which increased 525%.

Gold Price 1999 – 2011

Sprott then went on to compare that decade to our market situation today, with increasing interest rates causing unrecorded losses on the books of banks and other real estate lenders.

He estimated that there’s a “couple trillion of losses sitting on the balance sheets of US banks” and that’s the “elephant in the room“.

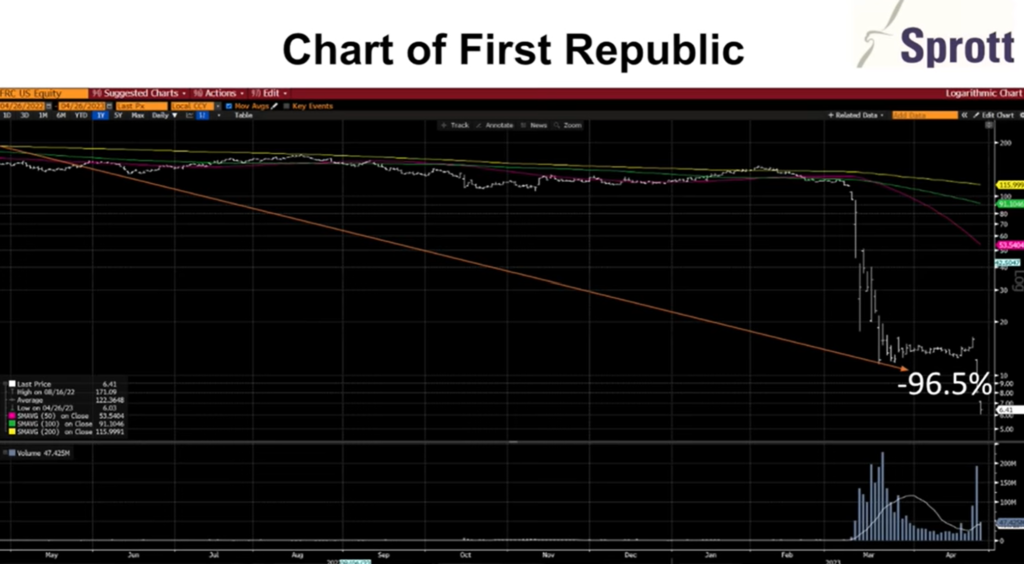

First Republic Stock Price

First Republic was the 14th largest bank in the country. Let’s look at another example, the 16th largest bank in the USA – Silicon Valley Bank – which collapsed on March 10, 2023, after a bank run. This was the 3rd largest bank failure in the history of the United States. According to Wikipedia, “the Federal Reserve raised interest rates to curb an inflation surge, causing unrealized losses on the portfolio.” First Citizens Bank acquired its $72-Billion in assets for $16.5-Billion.

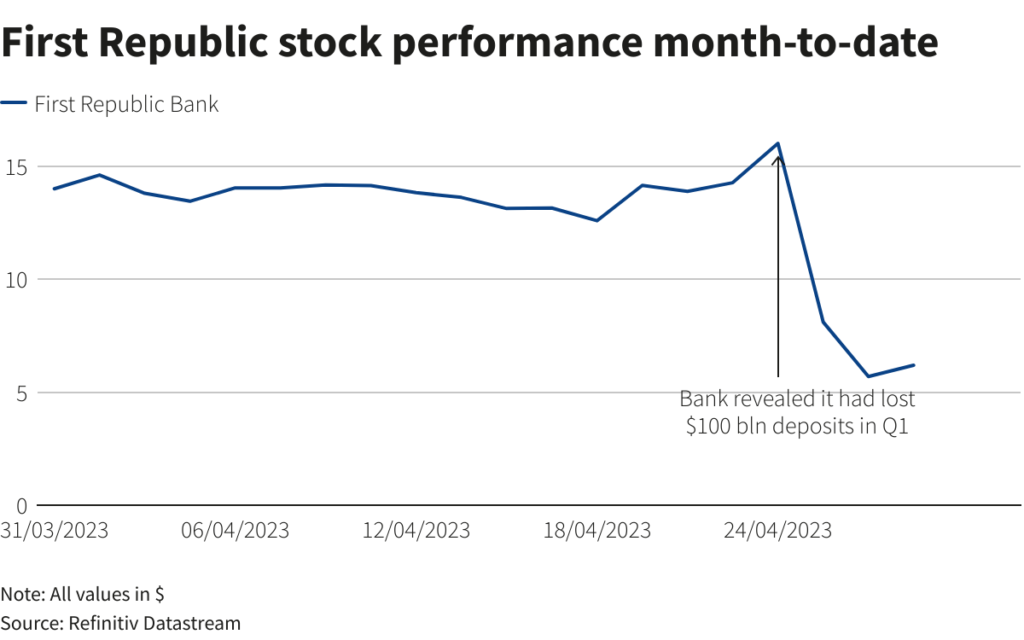

One month later, First Republic Bank also failed. On April 24, 2023, it announced that it has lost $100-Billion of deposits:

On May 1, 2023, First Republic wass “bought” by JPMorgan Chase for $10.6-Billion, after it had lost 99% of its value and was taken over by the FDIC. It’s clear that Eric Sprott believes there’s strong potential for a break-out in the gold price while the rest of the market deals with the negative implications of fluctuating interest rates.