Today we examine two prominent Exchange Traded Funds (ETFs) offering exposure to gold mining companies. Namely, VanEck Gold Miners ETF (GDX) and VanEck Junior Gold Miners ETF (GDXJ).

GDX offers exposure to the largest mining companies in the world, rough rule of thumb being those companies approximately $10-Billion market capitalization and over. GDX has 55 holdings (top 10 comprising 62.43%), while GDXJ has 98 holdings (top 10 comprosing 44.54%).

These are quite large ETFs relative to the industry, with the GDX at $12-Billion in total net assets and the GDXJ at $3.8-Billion.

Both have low expense ratios (GDX 0.51% Net Expense Ratio & 0.52% for GDXJ), with a yield of 1.60% for GDX and 0.67% for GDXJ.

GDX

VanEck describes the ETF as follows: “VanEck Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry.”

https://www.vaneck.com/us/en/investments/gold-miners-etf-gdx/overview/

GDX – Major Gold Mining Companies – Top 10 Holdings

| Company Name | Ticker Symbol | % of Net Assets |

|---|---|---|

| NEWMONT CORP | NEM US | 10.34 |

| BARRICK GOLD CORP | GOLD US | 9.06 |

| FRANCO-NEVADA CORP | FNV US | 8.34 |

| AGNICO EAGLE MINES LTD | AEM US | 7.53 |

| WHEATON PRECIOUS METALS CORP | WPM US | 5.97 |

| NEWCREST MINING LTD | NCM AU | 5.20 |

| GOLD FIELDS LTD | GFI US | 4.17 |

| NORTHERN STAR RESOURCES LTD | NST AU | 4.14 |

| ANGLOGOLD ASHANTI LTD | AU US | 3.91 |

| ZIJIN MINING GROUP CO LTD | 2899 HK | 3.76 |

| Top 10 Total | 62.43% |

GDXJ

The GDXJ is a higher-risk option, offering exposure to slightly smaller companies. The “J” stands for Junior, as in junior miners. In reality, these are quite large companies, including Kinross which has an $8-Billion market cap; just not quite as big as the largest gold

As for the GDXJ: “VanEck Junior Gold Miners ETF (GDXJ®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Global Junior Gold Miners Index (MVGDXJTR), which is intended to track the overall performance of small-capitalization companies that are involved primarily in the mining for gold and/or silver.”

https://www.vaneck.com/us/en/investments/junior-gold-miners-etf-gdxj/

GDXJ – Junior & Mid-Tier Gold Mining Companies – Top 10 Holdings

| Company Name | Ticker Symbol | % of Net Assets |

|---|---|---|

| KINROSS GOLD CORP | KGC US | 7.47 |

| ALAMOS GOLD INC | AGI US | 6.64 |

| PAN AMERICAN SILVER CORP | PAAS US | 5.99 |

| ENDEAVOUR MINING PLC | EDV LN | 5.36 |

| B2GOLD CORP | BTG US | 4.99 |

| EVOLUTION MINING LTD | EVN AU | 3.44 |

| INDUSTRIAS PENOLES SAB DE CV | PENOLES* MF | 3.18 |

| SSR MINING INC | SSRM US | 2.68 |

| HECLA MINING CO | HL US | 2.41 |

| OSISKO GOLD ROYALTIES LTD | OR US | 2.38 |

| Top 10 Total | 44.54 |

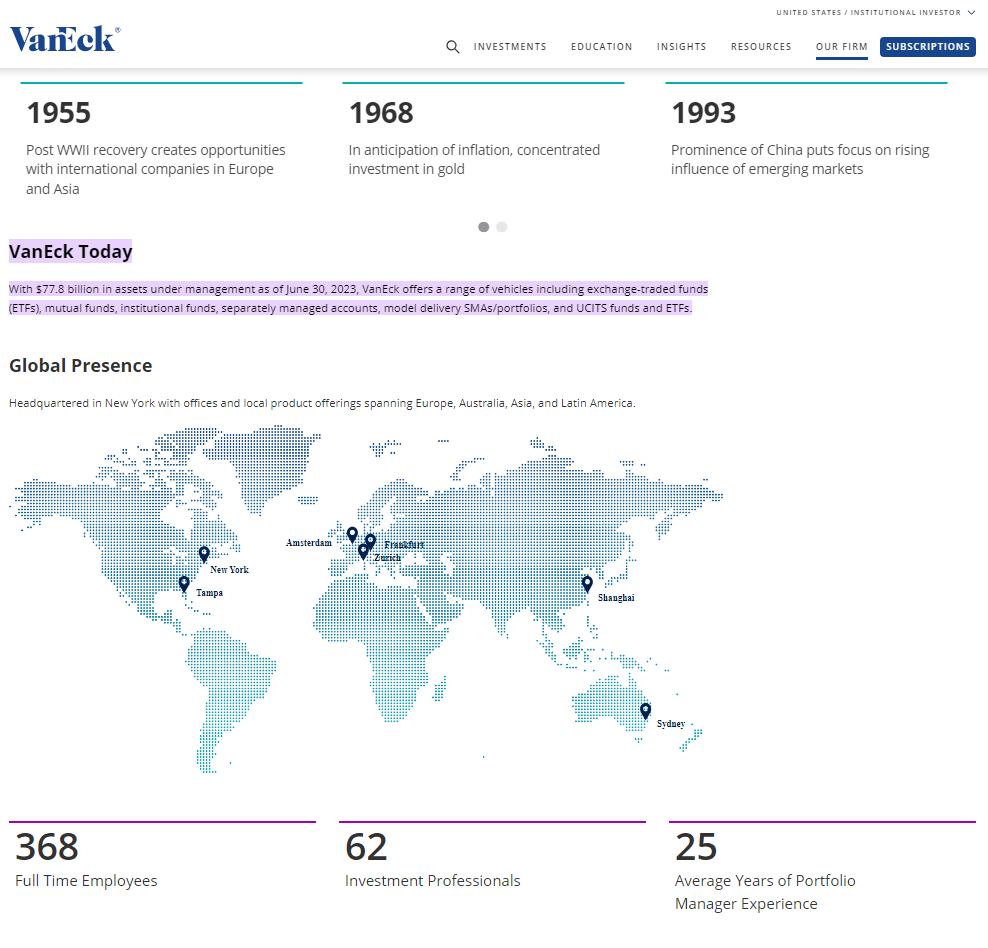

VanEck was founded in 1955 and manages approximately $78-Billion in assets.