Yes, I’m the analyst who predicted platinum & palladium’s rise. Admittedly, I was probably not the only person to have predicted it, and there was more than probably a great deal of luck involved. If the market for gold and silver is tiny (which it is, at 0.5% of money supply), the market for platinum group metals is miniscule.

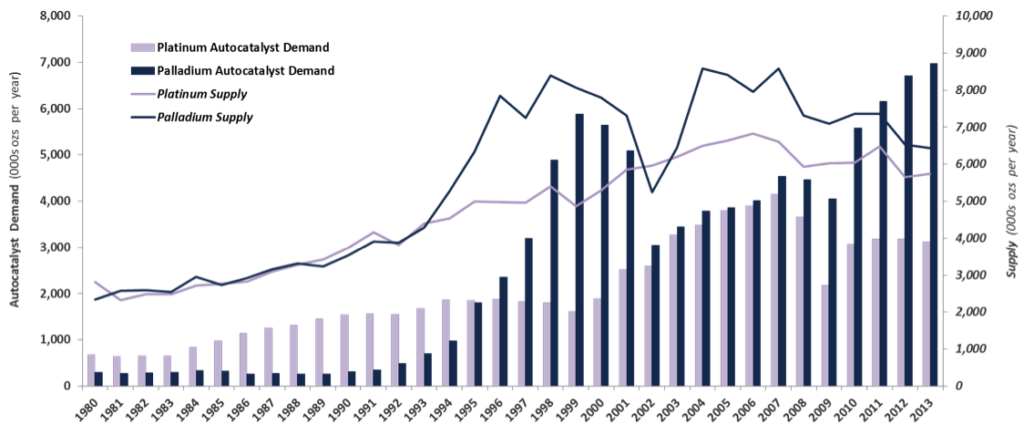

But it’s a very important market, especially considering over 60% of platinum group metals go toward automobiles. Yes, platinum and palladium are critical for catalytic converters, reducing emmissions from gas guzzling cars in a world increasingly burdened by pollution.

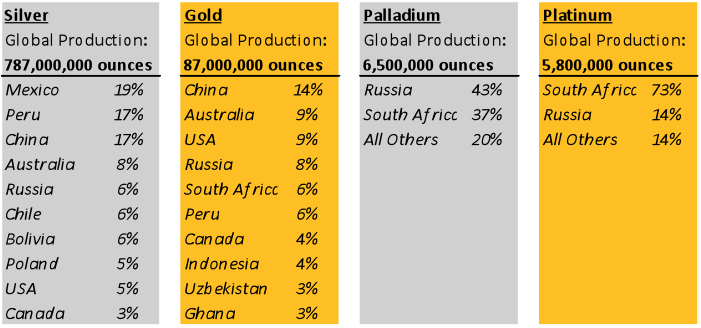

Platinum group metals are extremely rare. About ~100x rarer than silver and 10x rarer than even gold. Below is a chart I had put together to showcase just how rare platinum and palladium are:

Global Production of Platinum & Palladium (Approximate / 2013)

The question becomes, what will happen to platinum & palladium now if Electric Vehicles don’t need catalytic converters. Being a tiny opaque market is a double-edged sword, and these commodities can swing downwards just as fast they can rocket up.

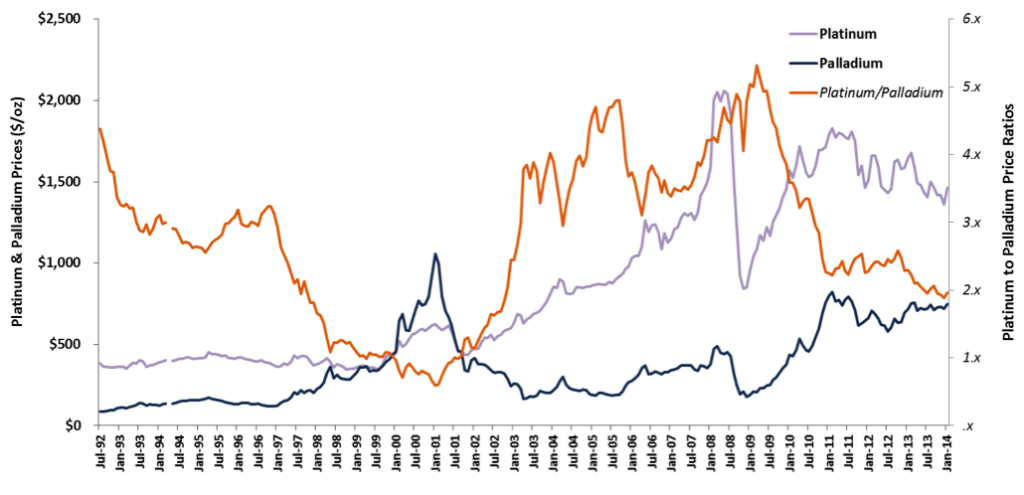

Having said that, it was rare for me to post publicly, but back in 2013/2014, I felt very strongly that the supply/demand dynamics for platinum group metals (palladium in particular) were uniquely poised to generate pricing increases for palladium.

So I logged onto SeekingAlpha and posted all about the unique market that is platinum/palladium, the need for catalytic converters to curb emmissions especially in pollutant countries like China, and the inability to produce enough of these metals in Russia and South Africa.

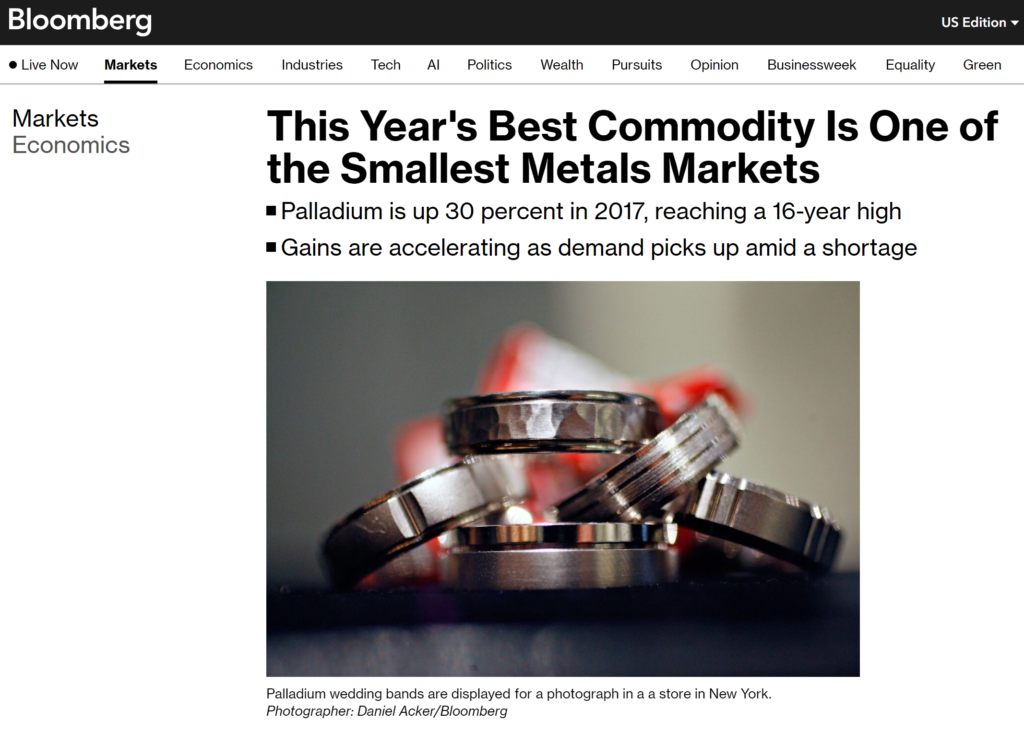

Fast forward 5 years, and palladium was being touted as the top commodity of the year. Bloomberg said “This Year’s Best Commodity Is One of the Smallest Metals Markets” in 2017:

And at the end of 2019, Barron’s added: “This year has been good for commodities, with palladium leading the way with a gain of nearly 60%.”

https://www.barrons.com/articles/commodities-had-a-great-year-why-palladium-led-the-way-51576845000

It was fulfilling to get to predict palladium’s rise, and then watch it hit new highs years after year for the better part of a decade. I guess even a broken clock is right twice a day.

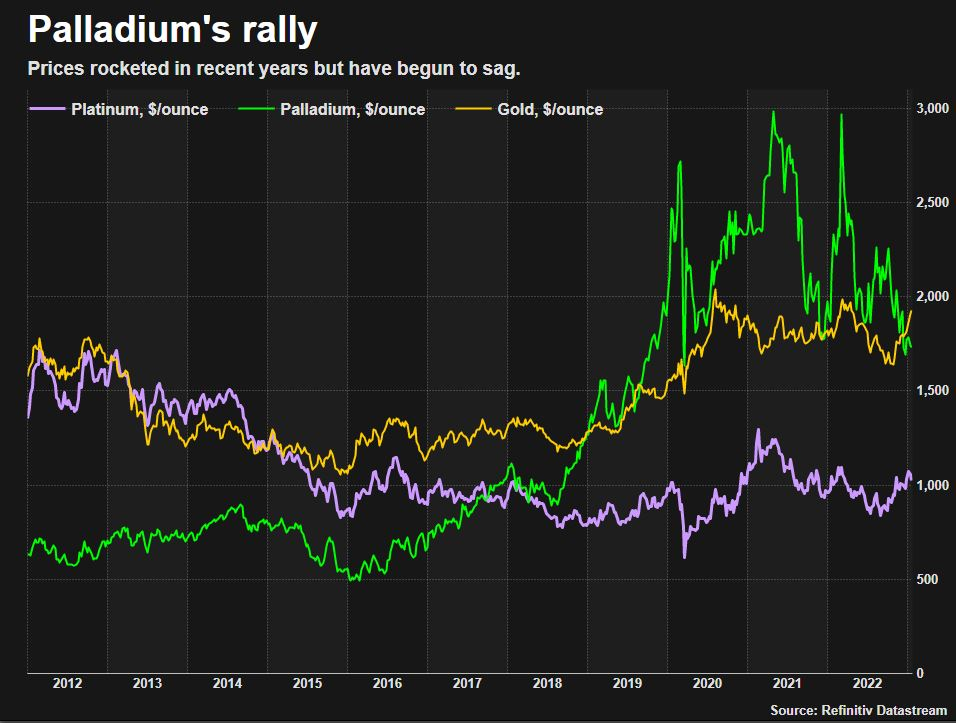

As for the future, I don’t have a strong conviction or prediction. Reuters doesn’t think palladium has much of a future due to Electric Vehicles, and they very well might be spot on. Reuters (Jan. 27, 2023): “An era of breathtaking palladium rallies is likely to be ending, analysts said, as rising supply and stagnant demand erode prices of the metal used to neutralise vehicle exhaust emissions. Palladium , once the cheapest major precious metal, rocketed from less than $500 an ounce in 2016 to above $3,400 last March, leaving platinum and gold for dust.”

You can see the original article from 2014 here: https://seekingalpha.com/article/2076903-platinum-and-palladium-changing-dynamics with some of the graphics I had generated shown below.

Price of Platinum vs Palladium

Supply & Demand for Platinum & Palladium