I’ve been a long time listener to the “All In” podcast, which is – in my opinion – one of the greatest podcasts in the world. Not just my opinion, apparently, as it is consistently ranked the #1,, #2 or #3 tech podcast in the USA.

What really surprised me though, was hearing top tech investor David O. Sacks (Co-Founder, Craft Capital) talk about the US Debt Crisis, Weaponization of the Dollar, De-Dollarization, and Gold as an inflation-resistant currency.

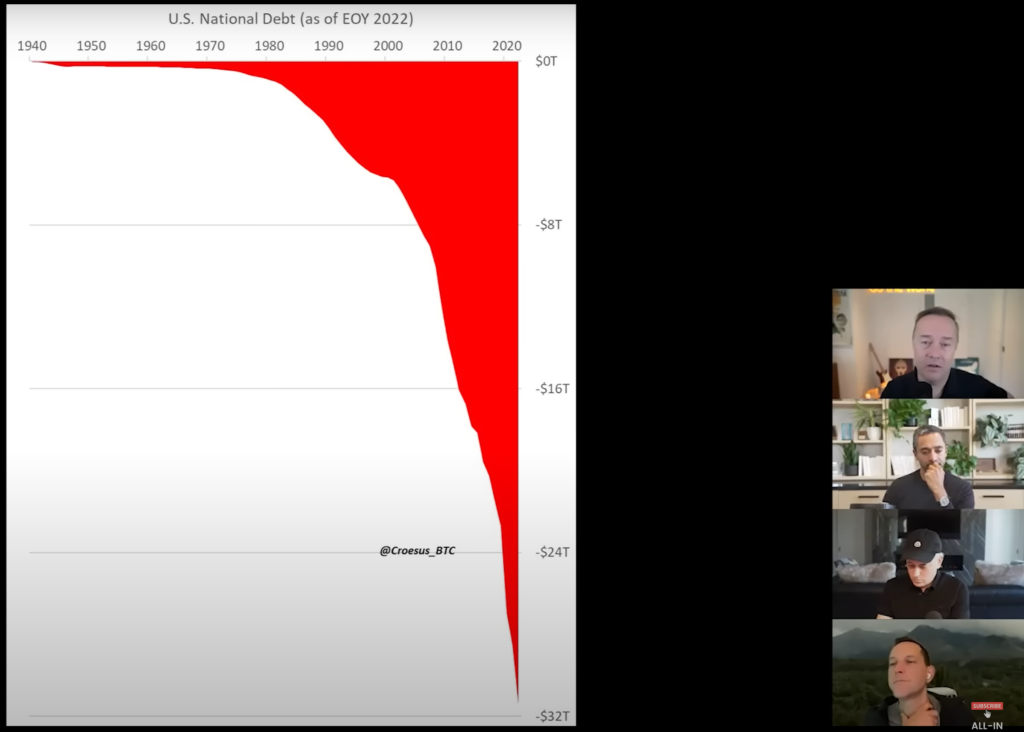

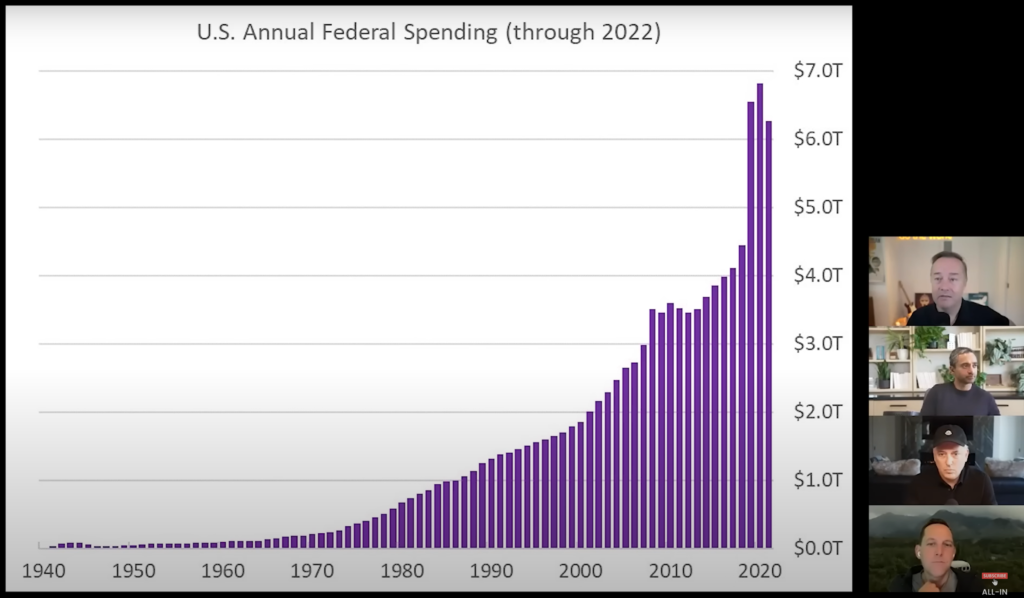

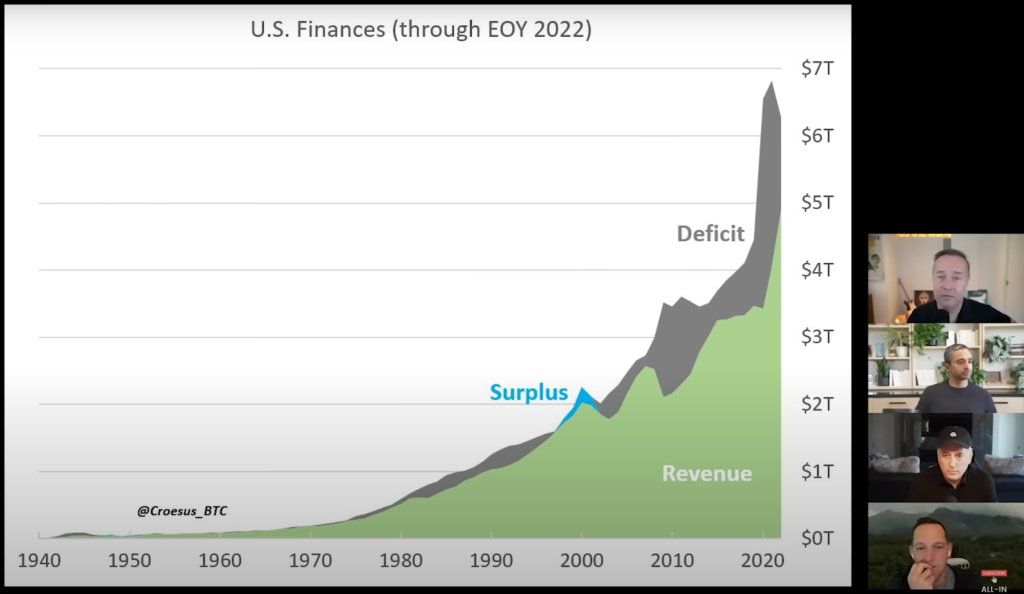

They thoroughly analyzed the massive levels of debt (over $30-Trillion) in the US, showcased that interest payments only will soon surpass even defence spending, and talked about the devaluation of the US Dollar and corresponding De-Dollarization (countries shifting away from the US Dollar and towards gold).

We took the liberty of clipping out David Sacks’ main points on these issues so you can listen to them in 6mins instead of the entire episode’s 1hr36mins here https://www.youtube.com/watch?v=zqiZVlwxxDw&t=2s&ab_channel=GoldSilverIndex

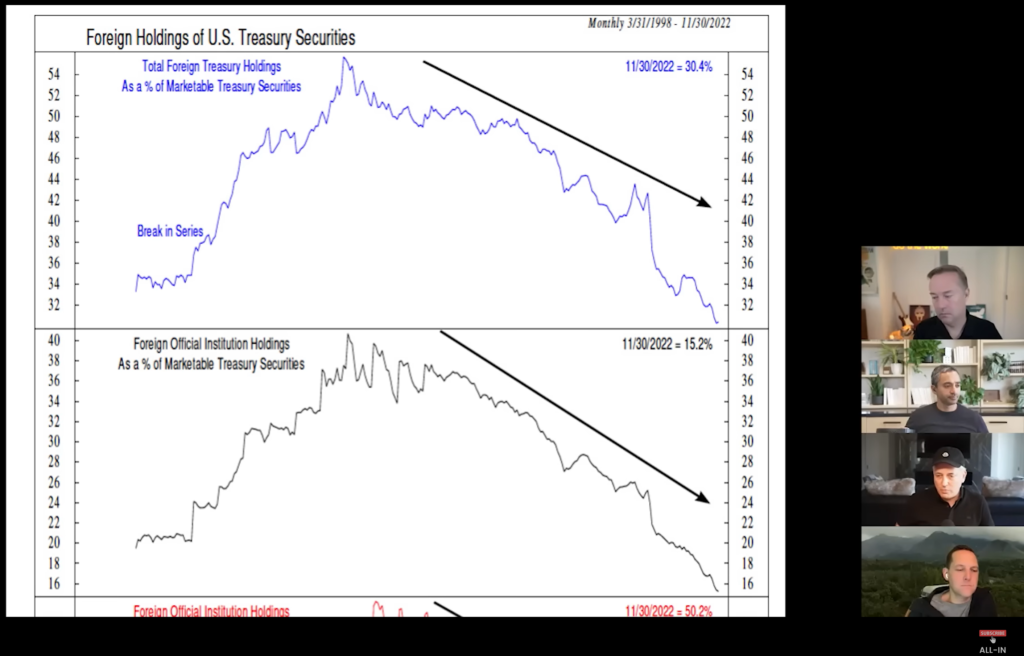

Foreign Governments Decrease Holdings of US Dollar

According to David Sacks, “BRICS Countries, Brazil, Russia, India, China, South Africa – and you can add Saudi Arabia into that bucket – are looking to diversify away from the US Dollar and are trying to do as many transactions as they can off the dollar, and they do not want to hold treasuries like they did 10 or 15 years ago.”

Weaponization of the US Dollar

As Sacks says, the US weaponized the dollar against Russia. Whether or not the sanctions were warranted, Russia has been forced away from the dollar. “What’s happening is deeply geopolotical. You’ve got a couple things going on. One is that the US has now instituted sanctions on over 40 countries. Moreover, the whole world saw that in the case of Russia, we froze their foreign reserves and basically seized the property of their oligarchs. So, if you’re an oligarch in the Middle East, do you think you want to keep all your money and all of your reserves in US Dollars? You understand that the dollar has been weaponized and is a political instrument of the United States. That’s just a fact. So, you’re going to look to diversify. You’re going to look to put your money in gold, you’re going to look to put your money in other currencies.

Conclusion

Toward the end of the segment, the moderator Jason Calacanis pushed David Sacks to “Answer the question! If you’re the CIO of Saudi Arabia where do you put your money?!” Sacks’ answer: “If I’m the Chief Investment Officer of Saudi, I put my money in gold. I would look to put it into gold.”

US National Debt Going Exponential

US Federal Spending – $6-7-Trillion Per Year

US Revenue vs Spending – Massive Deficits

Foreign Holdings of US Treasuries

Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil (Wall Street Journal)